Real Estate Syndication Investors can build wealth faster than traditional property buyers — but First-Time Real Estate Investors often lose money because they repeat the same avoidable errors. This guide explains the Common Mistakes First-Time Real Estate Syndication Investors make so you can protect your capital and grow with confidence.

Real estate syndication allows multiple investors to pool capital to buy large commercial properties such as apartment complexes, office buildings, or retail centers. While the structure offers access to bigger deals, it also introduces risks that are not always obvious to beginners.

For First-Time Real Estate Investors, excitement can overshadow due diligence. Many jump into deals based on glossy projections or persuasive sponsors without understanding the underlying risks.

Below are the six most common mistakes first-time Real Estate Syndication Investors make — and how you can avoid them.

Mistake 1 Ignoring the Sponsor’s Track Record

Many Real Estate Syndication Investors focus only on projected returns and forget the most important factor: the sponsor.

The sponsor controls:

- Exit strategy

- Deal selection

- Financing

- Operations

Why this matters

A great property with a bad sponsor means a bad investment.

What to do instead

- Review past performance

- Verify full-cycle deals not just current ones

- Ask about previous downturns and how they were handled

Highlighted insight: The sponsor’s integrity and experience matter more than the property itself.

Mistake 2 Believing the Projected Returns Without Verification

Pro formas frequently show attractive double-digit returns, but projections are not guarantees.

Common issues

- Overestimated rent growth

- Underestimated expenses

- Ignored vacancy risks

Smart investor behavior

✔ Stress-test assumptions

✔ Compare projections with current market data

✔ Ask what happens if returns fall short

First-time real estate investors should translate the above estimates into hypothetical scenarios rather than actual promises.

Mistake 3 Not Understanding the Deal Structure

Many investors do not understand how profits are split or when capital is returned.

Important elements to understand

- Preferred return

- Profit splits

- Waterfall structures

- Fees paid to sponsors

Why this is risky

You may think you’re getting 8 percent annually while most profits go elsewhere after fees.

Highlighted insight: If you cannot explain the deal structure simply, you should not invest in it.

Mistake 4 Failing to Analyze Market Risk

Even a well-run property fails in a weak market.

Red flags to check

- Population decline

- High new construction supply

- Employment concentration in one industry

Smart approach

✔ Research job growth

✔ Review rental demand trends

✔ Study supply pipelines

Strong markets protect returns even during economic slowdowns.

Mistake 5 Underestimating Illiquidity

Syndications are long-term investments.

Typical hold periods

- 5 to 10 years

- No early exit without penalty

- No public resale market

Why this hurts beginners

Some investors need cash earlier and panic when they cannot exit.

Highlighted insight: Never invest money you may need in the next few years.

Mistake 6 Skipping Legal and Tax Review

Many investors never review the Private Placement Memorandum or consult advisors.

Consequences

- Unexpected tax liabilities

- Risk exposure not understood

- Compliance issues ignored

Best practice

✔ Have a real estate attorney review documents

✔ Consult a CPA on tax implications

✔ Understand your legal rights

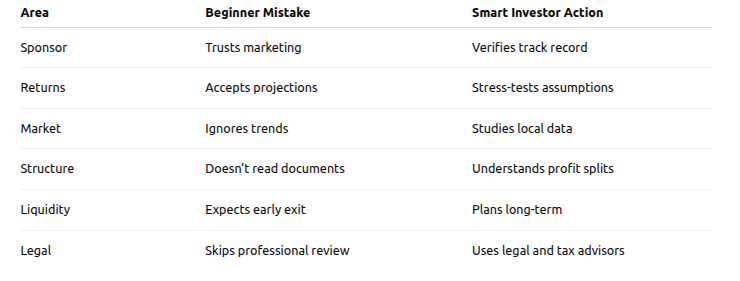

Comparison Table

Why Education Separates Profitable Investors From Risky Ones

The difference between profitable Real Estate Syndication Investors and those who lose money is not intelligence — it is discipline, and the ability to evaluate opportunities clearly, whether in large syndication deals or emerging niches like Plottage Real Estate.

First-Time Real Estate Investors who educate themselves:

Build sustainable portfolios

FAQ

What is real estate syndication

Real estate syndication is when multiple investors pool funds to purchase and operate a large property managed by a sponsor.

How much money do I need to invest in a syndication

Minimum investments usually range from $25,000 to $100,000 depending on the deal.

Is syndication safe for beginners

Yes, if beginners educate themselves, analyze deals properly, and work with reputable sponsors.

How long is my money locked in

Most deals require 5 to 10 years before capital is returned.

What returns should I expect

Returns vary, but conservative projections usually range from 6 to 12 percent annually depending on market conditions.

Conclusion

Real estate syndication is regarded as one of the strongest means of amassing wealth in today’s market. However, it is still an investment and, as such, it benefits diligence and lose attention.

By avoiding the common mistakes first-time real estate syndication investors make, you protect your capital, improve your returns, and grow with confidence.

At DMC Real Estate & Investments, we believe informed investors are successful investors. Our team focuses on transparency, education, and disciplined underwriting so our clients can invest with clarity and trust. Choosing the perfect partners, as well as asking the right questions, will be the defining factor in your success of real estate syndication whether you are assessing your first deal or finetuning your strategy.